E-Payment enables e-user to pay taxes using e-services of the system. There are two methods to pay taxes in a system:

1. The first method is to pay taxes using e-Payment services:

1.1. E-Payment using debit/credit card.

1.2. E-Payment using payment account.

2. Alternative method is when the person performs the common payment transaction in:

2.1. His/her e-banking system (the person should be e-user of that system).

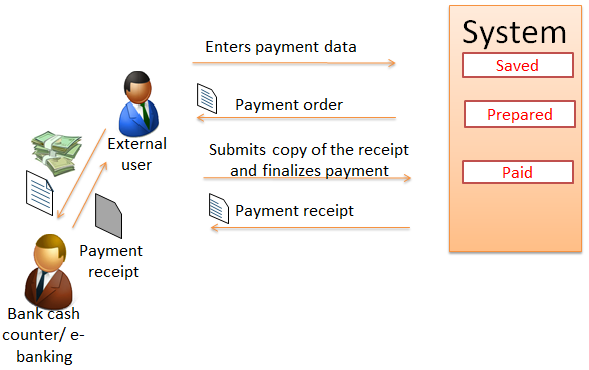

2.2. Bank’s cash counter. A receipt slip is submitted later in the system.

2.3. IRD’s cash counter. A receipt slip is submitted later in the system.

The process of payment is as follows:

1. You have to prepare payment order (see chapters 6.3. Create a new payment order, 6.5. Prepare payment order). NOTE. All Saved payment orders can be deleted (see chapter 6.4. Delete the payment order). And Not paid or Prepared payment orders can be canceled (see chapter 6.6. Cancel payment order). Both situations leads to the final state of the payment order – it cannot be used for payment longer.

2. Then you need to choose payment method e-Payment or receipt submission (see Figure 45 and Figure 46). Enter and submit payment data. Both methods are described in chapters 6.7. Perform e-Payment via gateway and 6.8. Submit the receipt of the payment transaction.

3. When payment order is prepared you can print it (for more details see chapter 6.9. Print the payment order).

4. If payment method is e-Payment, after successful transaction payment receipt is available for printing (see chapter 6.10. Print the payment receipt).

5. System allows you to search for a payment order in a list of payment orders (see chapter 6.1. Payment order search).

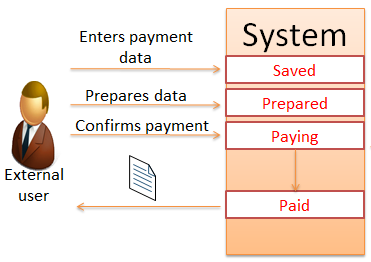

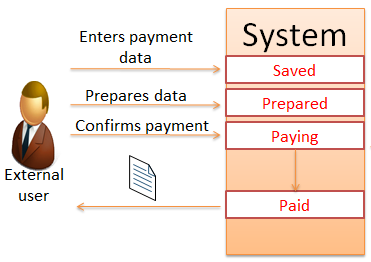

Figure 45 e-Payment procedure

Figure 46 Submitting a receipt

A payment order at different time can be in a different state, identifying the stage of e-Payment process. All available states of payment order are described in Table 11.

Table 11 States of payment order

|

State |

Description |

|

Saved |

A new payment order was created and saved. It is still in the editing mode. |

|

Deleted |

The payment order was deleted. |

|

Prepared |

The payment order was prepared and equipped with the unique number. It is ready for the payment. |

|

Paying |

The e-payment transaction according to the corresponding payment order was initiated and is being performed at the moment. |

|

Paid |

The payment according to the corresponding payment order was successful. |

|

Not paid |

The payment according to the corresponding payment order was unsuccessful and can be performed again. |

This chapter covers e-Payment functionality designed for external user role including:

•Search and view data of any order.

•Prepare a payment order.

•Perform e-Payment via gateway and see a received result.

•Print the payment order and payment receipt.

•Delete payment order.