If the payment order is in state “Prepared” or “Not-paid” you can perform e-Payment:

1. Open a list of payment orders and find a particular payment order (see chapter 6.1 Payment order).

2. Select a particular payment order and click [View] next to it.

3. Click [Perform e-payment]. A form for further payment is opened.

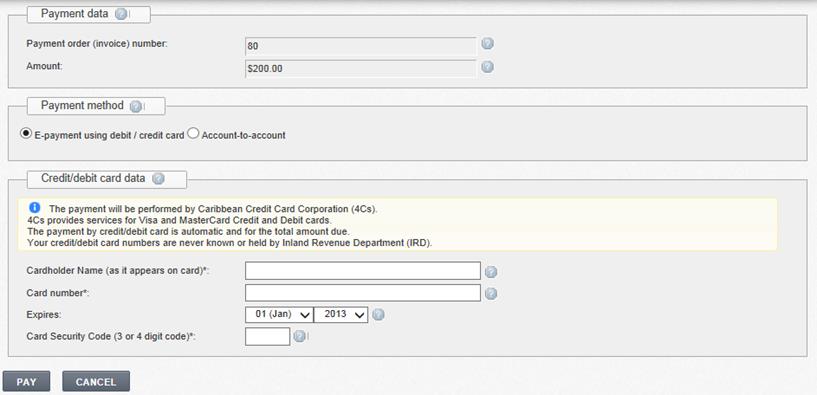

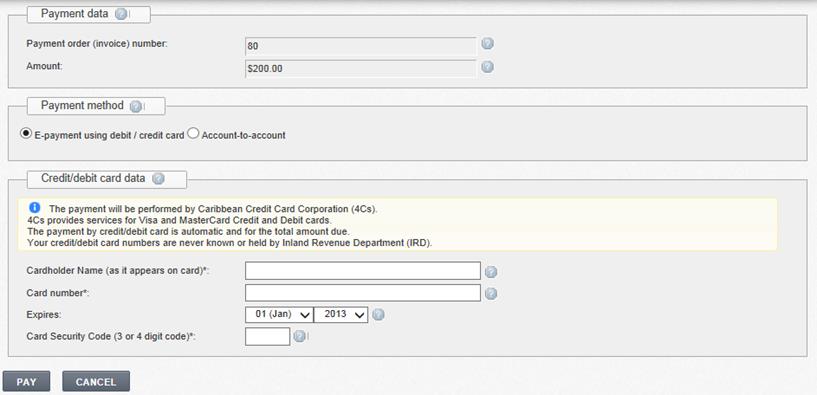

3.1. To perform the payment using credit/debit card, enter data of the credit/debit card (see Figure 51).

3.1.1. Enter credit/debit card’s data.

3.1.2. Click [Pay], to confirm payment transaction.

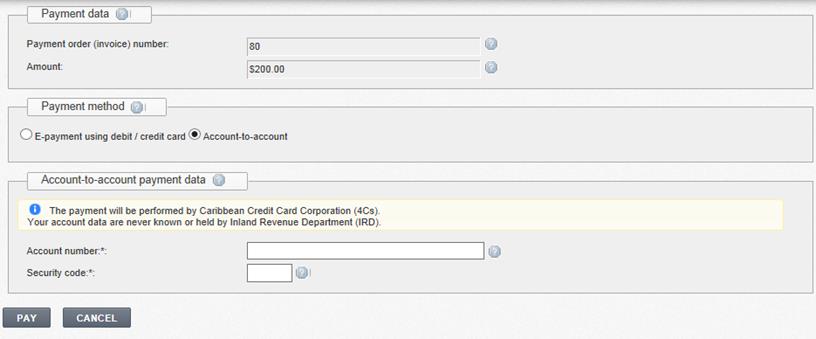

3.2. To perform the payment using account-to account method, mark radio button “Account-to-account” (see Figure 52).

3.2.1. Enter values into {Account number} and {Security code}.

3.2.2. Click [Pay]. If data is not correct system shows you an error message and payment transaction state is set to “Not paid”. You can try to pay again for more times. Each transaction can be found in a list.

4. The system displays a message that information about payment transaction will be received to Tax e-Filing system later and the user will be informed about that.

4.1. If payment transaction is successful, transaction’s and payment order’s state is set to “Paid”. A payment receipt is available for printing (see chapter 6.10. Print the payment receipt).

4.2. If payment transaction is not successful, transaction’s and payment order’s states are set to “Not paid”. You can execute another transaction.

NOTE. Your tax balance will be changed in several days, when payment data will be checked and approved. If there are any mistakes you’ll be informed by information message.

Figure 51 E-payment using debit / credit card