This chapter covers taxpayer's registration functionality. All applicable registration forms can be found in taxpayers current view list. Depending whether external user is registered as taxpayer or not, different applicable registration forms are displayed (for more details see chapter 3.1. View a taxpayer current view).

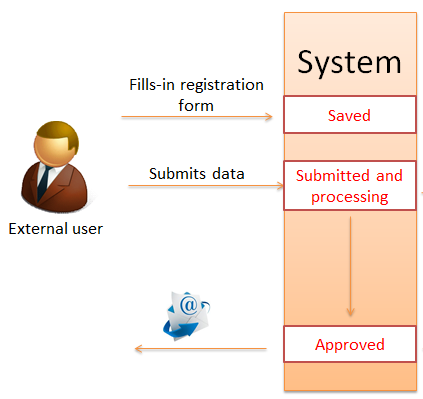

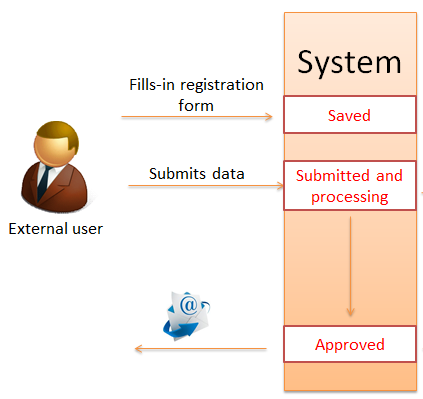

The process of taxpayer registration is described below and illustrated in Figure 12 and Figure 13:

•You have to prepare registration data in an applicable registration form. Read instructions given in chapter 3.3 Prepare and submit registration form. All submitted registrations can be found in the list of registration forms history (see chapter 3.6 View registration forms history).

•You'll receive an e-mail and an information message about your registration approval or rejection:

•If registration is approved, you are registered as a particular taxpayer.

•If registration is rejected you can retry to register.

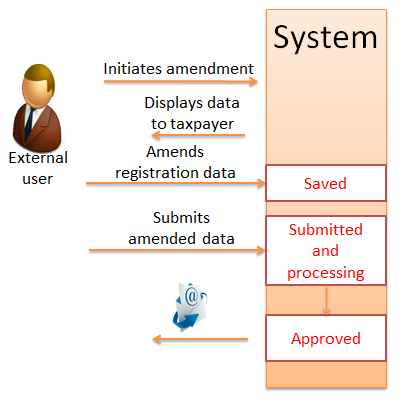

•Approved registration form can be amended. To amend registration form, use function 3.4 Amend registration data.

Figure 12 Taxpayers registration

Figure 13 Amendment registration

Every registration form has a state identifying what was done or can be done further with the registration. All states are described in Table 9.

Table 9 Registration form states

|

State |

Description |

|

Saved |

New registration form was created and saved. It is still can be edited. |

|

Submitted and processing |

Registration form was submitted by external user. It is waiting for the result of processing from SIGTAS. |

|

Deleted |

Registration form was deleted. |

|

Approved |

Registration form was approved in SIGTAS and information message was sent to user. New taxpayer was registered or data of the existing taxpayer was amended according to the submitted registration form. |

|

Rejected |

Registration form was rejected in SIGTAS and information message was sent to the user. |