This chapter covers these e-Filing functions:

•Online submission and validation of declaration;

•Data transfer to back-office system SIGTAS;

•Receipt to the taxpayer after successful e-Filing or meaningful error message indicating the reason for unsuccessful submission.

The system will also facilitate the registered taxpayer to enquire on his/her own tax account and e-Filing/e-declaration documents. It will provide document management facilities with the purpose of archiving and storing attachments and forms in accordance with the legislative requirements.

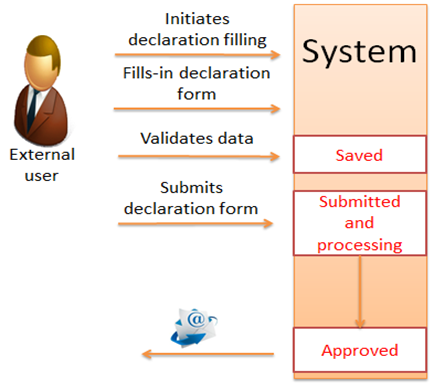

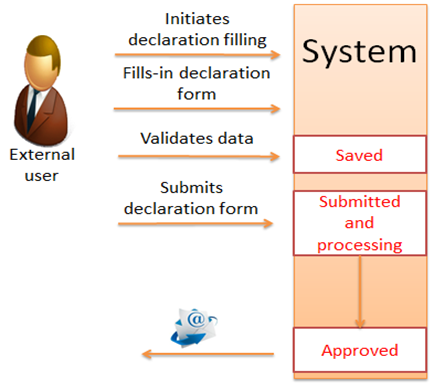

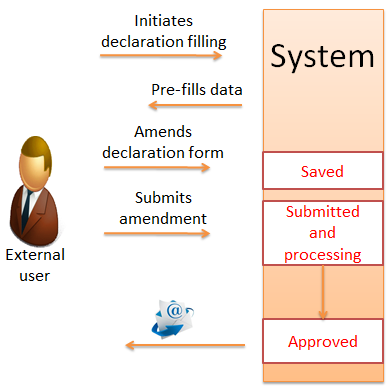

The process of declaration filling, submission and amendment is described below and drawn in Figure 35 and Figure 36.

•Firstly you have to fill in and validate declaration’s data in an applicable declaration form. Read instructions given in chapters 5.2. Start new declaration filling, 5.3. Edit declaration and 5.4. Submit a declaration).

•The system will send you an e-mail and information message about your declaration approval or rejection:

•If declaration is approved, you can amend it.

•If declaration is rejected you can amend rejected declaration.

•Only approved declarations’ can be amended. Amendment process is very similar to initial declaration filling and submitting. The only difference is that in case of amendment registration form is Filler with data approved after initial declaration approval. To amend declaration form, use function 5.7. Amend a declaration.

Figure 35 Declaration filing process

Figure 36 Process of declaration amendment

Every declaration is in a state identifying what was done or can be done further with a declaration. For descriptions of all states see Table 10.

Table 10 Description of declaration states

|

State |

Description |

|

Saved |

New declaration was created and saved. It remains in the editing mode. |

|

Submitted and processing |

Declaration was submitted by you. It is waiting for the result of processing from SIGTAS. |

|

Deleted |

The declaration was deleted. |

|

Approved |

The declaration was approved in SIGTAS and the status message was received in the system. Assessments according to the particular declaration were done in SIGTAS. An assessment notice was received in the system. |

|

Rejected |

The declaration was rejected in SIGTAS and the status message was received in Tax e-Filing system. |