To start to fill a new declaration, follow these steps:

1. Select menu "Declaration → Fill declaration". A list of saved declarations’ and a filter for choosing new declarations are opened (see Figure 37).

2. Select a tax period of chosen declaration from dropdown list {Tax period}.

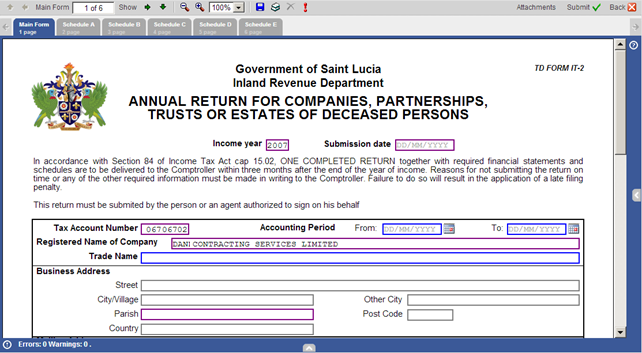

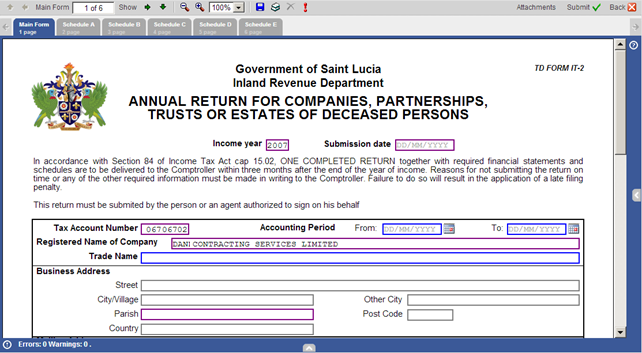

3. Click [Fill new]. Declaration is opened for filling in a filler form (see Figure 38) otherwise:

3.1. If there is a declaration in the state Submitted and processing, the system informs you that the analogical declaration is being processed at the moment and you cannot submit the amendment of it until the end of processing.

3.2. If there is a declaration in the state “Rejected”, the system informs you that the analogical declaration has been rejected by IRD and asks you, if you want to start filling a new declaration or to edit the rejected one.

3.3. If there is a declaration in the state “Approved”, the system informs you that the analogical declaration was approved and assessed by IRD. Then only an amendment is allowed.

3.4. If there is a declaration in the state “Saved”, the system informs you that filling of the analogical declaration has already been started. The system opens the particular declaration in the editing mode and uploads data in the latest version template of the same declaration form.

Figure 38 Declaration in a filler’s window