In order to become an external user of the system, you must to fill-in an application form:

1. Open Tax e-Filing system web page.

2. Click [Register user]. System opens an application window.

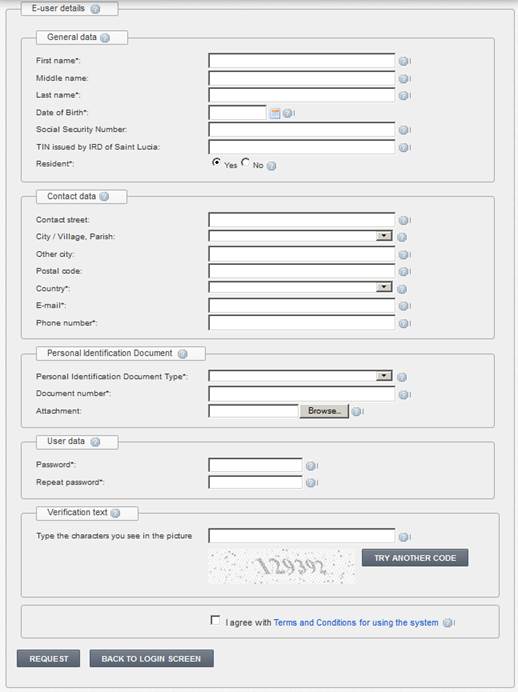

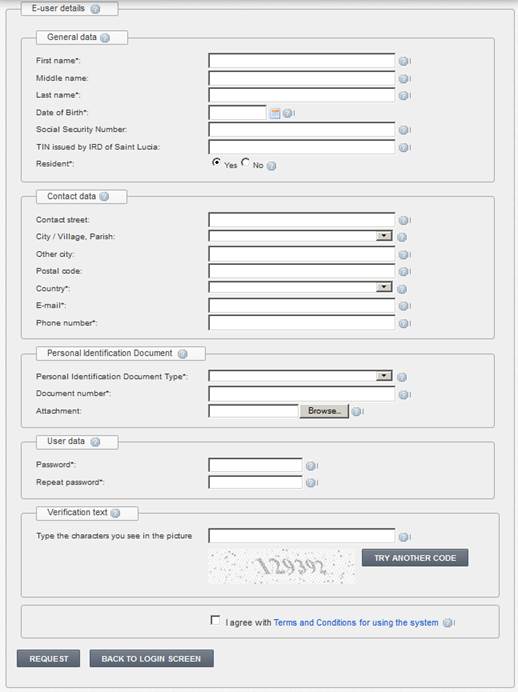

3. Fill in application data (see Figure 4 and Table 5) and enter verification text.

4. You should read terms and conditions for using the system and check the box as a sign of the agreement to them.

5. Click [Request].

5.1. If all mandatory data is entered and correct, an application for becoming an external user is submitted.

5.2. If data is not correct, error messages or rules are presented next to the specific field. Correct those errors and click [Request] again.

6. You are asked to confirm your request:

6.1. Click [OK] to submit your application. The system shows you an information message about successful operation.

6.2. Click [Cancel] to return to application form filling.

7. After submitting, your application state is set to Requested and an e-mail message is sent to your e-mail box.

8. Now you have to confirm your e-mail address (see chapter 2.2 Confirm e-mail).

Figure 4 External user application form

Table 5 Description of user data fields

|

Field name |

Description |

|

{First name*} |

Enter your first name. This field is mandatory. |

|

{Middle name} |

Enter your middle name. |

|

{Last Name*} |

Enter your last name. This field is mandatory. |

|

{Date of Birth*} |

Select your date of birth. This field is mandatory. |

|

{Social security number} |

Enter your social security number. If you don’t have social security number, leave this field empty. |

|

{TIN issued by IRD of Saint Lucia} |

This is the identification number of the taxpayer consisting of 6 digits. TIN can be entered applying for becoming an external user, or added later: •by changing personal data (see chapter 2.5 Edit personal data); •by submitting general taxpayer registration form (see chapter 3.3 Prepare and submit registration form) •by system administrator. Rules for TIN: •It should be unique among external users. •The taxpayer type must be ‘Individual’. •TIN should be registered and active in SIGTAS. These rules are checked by administrator: •On approval of your requested application. •If during the first approval you haven’t entered your TIN and want to add it later. •When administrator changes your TIN. |

|

þ Resident* |

This field is mandatory. If you are resident the field value must be ‘yes’ as it is by default. |

|

Contact data | |

|

{Street} |

Enter a name of the street you want to give as contact address. |

|

{City/Village} |

Select a value from the drop down list. All values are taken form “City” classifier. After comma a parish is shown as well. This field is mandatory if your contact address is resident. |

|

{Other city} |

Fill this field only if field {City/Village} is empty and the user contact address is not resident. |

|

{Postal code} |

Enter postal code of your contact address. |

|

{Country*} |

Select a value from a drop down list. Values are taken from countries classifier. This field is mandatory. |

|

{E-mail*} |

Enter your e-mail address. Field is mandatory and must be unique. |

|

{Phone number*} |

Enter yours contact phone number. This field is mandatory. |

|

Personal Identification Document | |

|

{Personal identification document type} |

A value can be selected from a drop down list. Values are taken from “Personal document types” classifier. This field is mandatory. |

|

{Number of document} |

Enter the number/code of your personal identification document. This field is mandatory. |

|

{Attachment} |

Click button [Browse] to specify Personal Identification Document image. Accepted file types are: •pdf, •doc, •docx, •png, •jpg, •jpeg, •tiff The file size should not exceed 4 megabytes. |

|

User data | |

|

{Password*} |

The value of this field will be a password used for login to the system. Rules for your password: •Minimum 6 characters. •At least one number is required. •At least one letter is required. |

|

{Repeat password*} |

Repeat your password. |

|

Verification text | |

|

{Type the characters you see in the picture} |

This field is mandatory. By entering symbols from a picture you verify that you are a human being. |

|

[Try another code] |

Click this button to regenerate symbols in the picture. |

|

þ {I agree with Terms and Conditions for using the system} |

This field is mandatory. It confirms that you’ve read terms and conditions for using Tax e-Filing system. |

|

Terms and Conditions for using the system |

Click this link to read terms and conditions for using Tax e-Filing system. |

|

Buttons | |

|

[Request] |

Click this button to submit the application when all necessary information is entered. |

|

[Back to login screen] |

Click this button to return to login screen. |